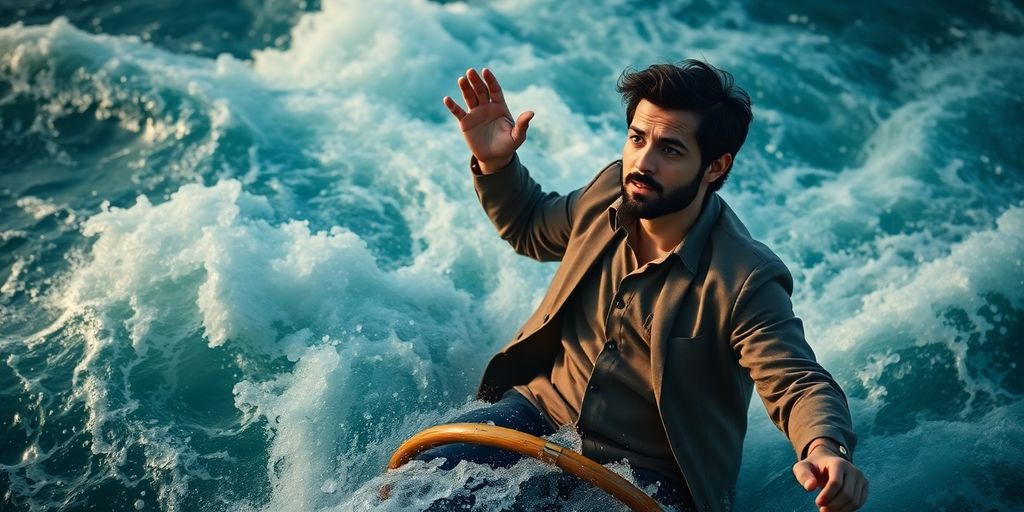

Market swings can feel pretty rough, right? It's like trying to ride a bike with a wobbly wheel – you're never quite sure what's coming next. We've all been there, feeling that little knot of worry when the news talks about economic ups and downs. But honestly, it doesn't have to be a constant source of stress. With a few smart moves and a clear head, you can actually steer through these choppy waters and come out the other side feeling pretty good about your money. This is all about making sense of market volatility advice and turning those uncertain times into something you can handle.

Key Takeaways

- Understand that market ups and downs are normal and can even be opportunities.

- Keep your long-term goals in sight and avoid making rash decisions based on daily news.

- Spreading your money across different types of investments helps reduce risk.

- Learn to manage your emotions so they don't drive your investment choices.

- Having a plan and sticking to it, even when things get bumpy, is key.

Embrace Market Volatility with Confidence

Markets can feel like a wild ride sometimes, right? One day things are up, the next they’re down, and it’s easy to get a little freaked out. But here’s the thing: these ups and downs, this volatility, it’s just part of the game. It’s not always a bad thing, either. Think of it like this: without some bumps, you wouldn’t get the big wins. It’s all about finding that balance.

So, how do we deal with it and actually feel good about our money?

- Understand that market swings are normal. Seriously, they happen all the time. Since the 1950s, the market has seen dips of 5% or more about three times a year. Knowing this can help you not panic when it happens.

- Don't let your gut feelings take over. When you see your investments drop, it’s natural to feel anxious. But acting on that fear, like selling everything, can actually hurt you more in the long run. You might miss out on the recovery.

- Focus on the big picture. It’s easy to get caught up in the day-to-day noise. But investing is usually a marathon, not a sprint. Keeping your long-term goals in mind helps you stay steady when the market gets shaky.

Remember, even big market drops are usually temporary. History shows that markets tend to go back up over time. The key is to stay put and not make rash decisions based on short-term worries.

Strategic Approaches to Market Volatility Advice

Market swings can feel like a wild ride, right? One minute things are up, the next they're down. It's easy to get caught up in the day-to-day ups and downs, but that's usually not the best way to handle your money. Instead, let's look at some smart ways to keep your investments on track, even when the news sounds a bit shaky.

The Power of Diversification

Think of diversification like not putting all your eggs in one basket. If you spread your money across different types of investments – like stocks, bonds, and maybe even some real estate – you're less likely to be hit hard if one area takes a big dip. It’s a tried-and-true method for managing risk. We help clients build portfolios that are spread out, so if one part of the market isn't doing so well, others might be picking up the slack. It’s all about creating a more balanced approach to your investment goals.

Maintaining a Long-Term Investment Horizon

It’s really tempting to make quick decisions when the market gets choppy. You see your account balance drop, and your first thought might be to sell everything. But history shows us that markets tend to go up over the long haul, even with those bumpy periods. Staying invested for the long term is often the most effective strategy. Trying to time the market is incredibly difficult, and you could end up missing out on the best days, which can really hurt your overall returns. We focus on keeping you aligned with your original plan, helping you avoid those emotional reactions that can cost you.

Tactical Adjustments for Evolving Markets

While we always keep the long view in mind, that doesn't mean we just set it and forget it. Markets change, and sometimes it makes sense to make small tweaks to your portfolio. This could involve things like rebalancing – selling a bit of what has grown a lot and buying more of what has gone down – or even looking at tax-loss harvesting to help reduce your tax bill. These are smart moves that can help you take advantage of market conditions rather than just reacting to them. It’s about being prepared and making informed choices as things shift.

Mastering Your Investment Decisions

It's easy to get caught up in the day-to-day ups and downs of the market. When things get a little bumpy, our first instinct might be to panic or make rash decisions. But honestly, that's usually not the best move. Think about it like this: if you were trying to get somewhere new, you wouldn't just randomly change direction every time you saw a pothole, right? You'd stick to your map and keep going.

Overcoming Emotional Investing Habits

Our emotions can really play tricks on us when it comes to money. Fear and greed are powerful forces. When the market drops, fear can make us want to sell everything, even if it means locking in a loss. On the flip side, when things are booming, greed can push us to take on too much risk. It's important to recognize these feelings and try to keep them in check.

- Pause before you act: When you feel an urge to make a quick change to your investments, take a deep breath and step away for a bit. Give yourself time to think clearly.

- Focus on facts, not feelings: Look at the data and your long-term plan, not just the headlines or how you feel in the moment.

- Talk it out: Discuss your concerns with a trusted friend, family member, or financial advisor. Sometimes just saying it out loud helps.

Trying to time the market, jumping in and out based on short-term predictions, rarely works. In fact, missing just a handful of the market’s best days can significantly reduce long-term returns. Historical data shows that an investment could have grown significantly if fully invested, but missing just the ten best days could have cut returns by more than half. This really highlights the importance of staying invested through market ups and downs to capture long-term growth.

Enhancing Financial Security Through Diversification

Spreading your money around is like not putting all your eggs in one basket. If one investment isn't doing so well, others might be picking up the slack. This helps to smooth out the ride and makes your overall financial picture more stable. It's a smart way to protect what you've built.

Tracking Your Financial Progress Like a Pro

Knowing where you stand is super important. Regularly checking in on your investments helps you see what's working and what's not. It's not about obsessing over daily changes, but more about understanding the bigger picture and making sure you're still on track with your goals. This kind of regular check-in can give you a real sense of control and confidence in your financial journey. You can navigate volatile markets with an investing plan by keeping a close eye on your progress.

Unlocking Wealth Through Smart Investing

It’s easy to get caught up in the day-to-day ups and downs of the market, but the real magic happens when you focus on smart, long-term strategies. Think of it like planting a garden; you don't expect to harvest tomatoes the next day. You prepare the soil, plant the seeds, water them, and let them grow. Investing is similar. By identifying good opportunities and sticking with them, you can really build up your wealth over time.

Identifying Profitable Investment Opportunities

Finding the right places to put your money can feel like a treasure hunt. It’s not just about chasing the latest hot stock. It’s about looking for companies or assets that have solid foundations and good potential for growth. This means doing a bit of homework, understanding what makes a business tick, and looking for value that others might be overlooking. Sometimes, the best opportunities aren't the loudest ones.

- Research companies: Look into their business model, leadership, and financial health.

- Understand market trends: What industries are growing? What needs are not being met?

- Consider diversification: Don't put all your eggs in one basket. Spread your investments around.

The key is to be patient and look for quality. It’s better to find a few solid investments that you understand than to jump into many you don’t.

Developing a Long-Term Investment Strategy

Once you’ve found some promising investments, the next step is to create a plan. This isn't about trying to guess what the market will do tomorrow. It’s about setting goals for where you want to be in five, ten, or even twenty years. A good strategy helps you stay on track, even when the market gets a little bumpy. It’s your roadmap to financial success.

- Define your goals: What are you saving for? Retirement? A down payment?

- Determine your risk tolerance: How much fluctuation can you comfortably handle?

- Set a timeline: When do you need the money?

Sticking to a plan, like using dollar-cost averaging, can help smooth out the ride and keep you focused on the long game. It’s about consistency and discipline.

Building a Sustainable Financial Future

Ultimately, smart investing is about building a future where you feel secure and have the freedom to live the life you want. It’s not just about accumulating money; it’s about creating a stable foundation that can support your dreams and provide for your loved ones. This takes time, patience, and a commitment to your plan. By making informed choices today, you’re setting yourself up for a much brighter and more secure tomorrow.

Navigating Risk with Expert Market Volatility Advice

Market ups and downs can feel like a wild ride, right? It’s totally normal to feel a bit uneasy when things get choppy. But here’s the thing: volatility is just part of the investing game. Instead of fearing it, we can learn to work with it. Think of it like this: a bumpy road can sometimes lead to the most scenic views. By understanding how markets swing and having a plan, you can actually turn those uncertain times into chances to grow your money.

Understanding Risk Management Principles

So, what does managing risk really mean when the market is doing its own thing? It’s not about avoiding risk altogether – that’s pretty much impossible in investing. It’s more about being smart about the risks you take. We want to make sure the potential rewards are worth the chances you’re taking.

Here are a few ways to think about it:

- Know your limits: What’s your comfort level with potential losses? This helps set the stage for your investment choices.

- Don’t put all your eggs in one basket: Spreading your money around different types of investments is a classic for a reason. If one area takes a hit, others might be doing just fine.

- Keep an eye on the big picture: It’s easy to get caught up in daily market noise, but remembering your long-term goals helps keep things in perspective.

It’s really about making informed choices. When you understand the potential downsides and have a strategy in place, you can approach market swings with a lot more confidence. It’s like knowing how to drive in different weather conditions – you’re prepared for what might come.

Adapting Investment Strategies for Flexibility

Markets change, and our investment plans should be able to change with them. Being flexible means you’re not stuck with a plan that no longer fits. It’s about being ready to make smart adjustments when needed, without throwing the whole strategy out the window.

Think about these points:

- Regular check-ins: Periodically reviewing your portfolio helps you see if it’s still aligned with your goals and current market conditions.

- Diversification is key: As mentioned, having a mix of investments across different areas is your first line of defense. It gives you options.

- Stay informed, but don’t overreact: Knowing what’s happening in the market is good, but reacting impulsively to every bit of news can be harmful. A balanced approach is best.

Achieving Financial Freedom Through Informed Choices

Ultimately, all of this – understanding risk, staying flexible – is about building a secure financial future. It’s about making choices today that set you up for success tomorrow. When you’re informed and have a plan, you gain a real sense of control over your financial journey. That’s where true financial freedom starts to take shape.

Your Partner in Financial Growth

Sometimes, the market feels like a wild ride, right? It’s easy to get caught up in the day-to-day ups and downs, but having someone in your corner can make all the difference. Think of it like having a co-pilot on a long flight; they help you stay on course, especially when the weather gets a bit choppy. We’re here to be that steady hand for your financial journey.

The Importance of Communication and Trust

Building a strong relationship with your financial partner is all about open and honest chats. We believe in keeping you in the loop, explaining what’s happening, and why we’re making certain moves. It’s not just about numbers; it’s about making sure you feel comfortable and confident with the plan we’ve put in place together. When you understand what’s going on, it’s much easier to stick to the plan, even when markets get a little shaky.

Leveraging Expertise for Your Financial Journey

Navigating the world of finance can be complex, and honestly, who has the time to become an expert in everything? That’s where we come in. We bring the knowledge and experience to the table, helping you make sense of market movements and how they might affect your personal goals. We’re constantly looking at the bigger picture, so you don’t have to.

Staying Invested for Long-Term Success

It’s tempting to react when markets swing, but often, the best move is to stay put. We help you remember your long-term goals and the strategy we built to get there. Think of it like this:

- Focus on the destination: Keep your eye on what you want to achieve, whether it’s retirement, a new home, or something else entirely.

- Trust the process: A well-thought-out plan is designed to handle market ups and downs.

- Avoid impulsive decisions: Knee-jerk reactions can often do more harm than good.

By staying committed to your investment strategy, you give your money the best chance to grow over time. It’s about patience and letting the power of compounding work its magic.

Staying the Course

So, we've talked a lot about how markets can swing around, and yeah, it can feel a bit wild sometimes. But remember that whole thing about patience and sticking to the plan? It really does pay off. Think of it like this: even when things get bumpy, keeping your investments steady and spread out is key. History shows us that markets tend to bounce back, and by staying invested, you're in a much better spot to catch those upswings. Don't let the short-term noise distract you from your long-term goals. Keep a level head, trust the process, and you'll be well on your way to a more secure financial future.

Frequently Asked Questions

What exactly is market volatility?

Market volatility means that prices in the stock market go up and down a lot, and often. It's like a roller coaster! While it can feel scary, it's a normal part of investing. Sometimes, these ups and downs can even be good chances to make money if you know how to handle them.

How does spreading my money around (diversification) help during shaky markets?

Think of diversification like not putting all your eggs in one basket. If you spread your money across different types of investments, like stocks in different companies, bonds, and maybe even real estate, you lower the risk. If one investment does poorly, the others might do well, helping to balance things out.

Should I sell my investments when the market goes down?

It's easy to get scared when the market drops and want to sell everything. But often, the market bounces back. Trying to guess when to buy and sell, or ‘timing the market,' usually doesn't work. It's generally better to keep your investments for a long time, even when things are bumpy, to let them grow.

Can market drops be a good time to buy investments?

Yes, definitely! When the market drops, some investments become cheaper. Buying them at a lower price can be a smart move because they might go up in value later. It's like getting a good deal on something you know will be worth more in the future.

How do my feelings affect my investment choices, and what can I do about it?

Emotions can trick you into making bad choices with your money. When the market is wild, you might feel fear or greed. It's important to try and stay calm and make decisions based on facts and your long-term plan, not just how you feel in the moment.

What is a long-term investment strategy and why is it important?

A long-term investment strategy means you have a plan for your money over many years, not just a few months. This plan helps you stay focused on your goals, like saving for retirement, and guides you to make smart choices even when the market is unpredictable.